Today's post isn't going to be a deep dive, but rather something for me to look back on a few years from now. I'd like to tell you a little bit about why I started writing.

The Background

I come from a very modest background in Singapore. Given that both my parents received little to no education, the advice that my dad always gave me was to study hard, in order not to end up like them (working on low-paying jobs). Those words of his stuck with me for a very long time. I saw firsthand how hard my parents worked and all I wanted to do was to achieve good grades, receive a good University placement and a stable job so that they can retire sooner.

In the final year of my studies, I purchased my first investing book, Expand your Circle of Competence. I remember it was December 2019, and that book inspired me to delve deeper into the world of investing.

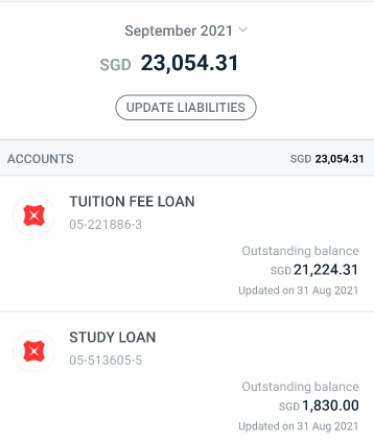

I was on a student loan for my university fees, which were around $24k, and I saw how the author turned $50k into $500k in four years. Granted, the author mentioned that some luck was involved, but it still piqued my interest as to how wealth can be generated in the stock market. I went to the authors' introductory session for a course they were putting on. That was before COVID19 came along and brought the entire world to a halt. I was already in the negative net worth territory when I started, so I couldn't join the course no matter how much I wanted to.

That means there was only one way I could get better at investing — self-study.

I began reading any investing books I could find, books like Common Stocks and Uncommon Profits by Philip Fisher, One Up on Wall Street by Peter Lynch, and 100 Baggers by Chris Mayer were some of the better ones that I’ve read. There’s more, but I can say if you‘ve read those 3, you probably have sufficient knowledge to dip your toes into the stock market.

That is precisely what I did.

You know that feeling you get after reading a few investing books and thinking you're an investing prodigy? I couldn't wait to put my newfound knowledge to the test and I bought my first stock. Everything was fine until COVID arrived and knocked the stock down 50% from its highs. I maintained my composure, and the markets eventually recovered. I ended up selling it for a 30% profit. Phew. Investing in my first stock only to see it drop 50% in the next two months? Mad.

The Spark

I discovered #fintwit in July 2020, and that's when I realized this is where all the good investors are hiding. I'd dare say that Fintwit and the numerous articles and podcasts it directed me to are responsible for the majority of my current investing knowledge. I started learning about many interesting companies through deep dives from various authors, and I found myself learning much faster than I used to.

If you haven't read Eric Jorgenson's book “Almanack of Naval Ravikant,” I strongly advise you to do so; it's free! It has changed the way I think about many things and provided me with new perspectives. I'm sure the book has done the same for many others.

In the book, Naval Ravikant frequently mentions the use of leverage.

Probably the most interesting thing to keep in mind about new forms of leverage is they are permissionless. They don’t require somebody else’s permission for you to use them or succeed. For labor leverage, somebody has to decide to follow you. For capital leverage, somebody has to give you money to invest or to turn into a product. - Naval Ravikant

I also liked reading Jeff Bezos' shareholder letters. It's incredible how a company can be rewarded for thinking long-term and consistently creating value for their stakeholders.

"If you want to be successful in business (in life, actually), you have to create more than you consume. Your goal should be to create value for everyone you interact with. Any business that doesn't create value for those it touches, even if it appears successful on the surface, isn't long for this world. It's on the way out.”Jeff Bezos, in his last shareholder letter in 2021.

I considered how I could generate leverage while also producing more content than I consumed. As a result, I decided to write my first deep dive on Peloton. Peloton was a company I had been following for a long time since it was trading in the $60s, and a company I had also been skeptical of for a long time.

I did some scuttlebutt on the company and discovered that it had excellent ecosystem control. Subscribers were pleased with their service (they saw great results after working out), employees enjoy working for the company (high employee ratings on Comparably), and they had control over the production of bikes and treadmills (they bought over the Taiwan factory). The company was not only gaining market share in the Connected Fitness space, but it was also adding value to their customers' lives. This was a company I knew I could see myself owning in the long run if it kept performing well.

I procrastinated for a long time, primarily due to self-doubt in my own abilities and the fear of being mocked by my friends and family. Why would anyone be interested in what I have to say? What if my article is a dud? That was stupid, now that I think about it.

The truth? Nobody gives a damn. Everyone is too preoccupied with their own lives to care if you write something bad. If I wait for myself to be ready, I'll probably never be ready. I needed to get comfortable with being uncomfortable. As a result, I shared my first deep dive on Twitter.

The Surprise

Back then, I only had 30 followers. Yes, 30 followers. I mean, sharing a deep dive with 30 followers? Who cares about someone with only 30 followers? Guess what?

The best things in life happen unexpectedly.

The next day after I published, I noticed my DM button had a notification for the first time. Kris, a well-known writer from Seeking Alpha, DM-ed me and asked if I'd be interested in writing for his service Potential Multibaggers! I took up the opportunity eventually because I believe it will help me both as a writer and as an investor by allowing me to hear the perspectives of other investors who are far more experienced than me, as well as learn as I continue to write.

When you put your ideas onto the Internet, you’re creating little robots, that can carry your ideas all around the world. And there are people, sitting from Malaysia, Mauritius to Algeria, who are scrolling the Internet, and they want to learn about whatever it is you have written about. And when you’re sleeping, when you’re out playing tennis, you pay no charge and those robots, are delivering your ideas to people all over the world. And what's amazing is that you can make something once, and the robots will work for you, for the rest of your life. - David Perell, Write of Passage

Since then, I have written 3 deep dives, and have gotten a chance to connect with other investors on Twitter. Who knew taking the first step could have brought me other opportunities to speak with people who lived in different time zones? The interactions that I get now? Never in my wildest dreams.

The Advantage of not being an Expert

I haven’t been writing lots of deep dives. It’s just difficult for me to really understand a company well enough to write a deep dive every other week. If you have read any of my other articles, you can probably tell that I try to be more detailed in my writeups, and all these take time.

I used to think that I had to be an expert in something to really share my thoughts on it. The thing is, you don’t really need to be a genius to share your views, to document your work. And being new to investing helps me write with better clarity, I think.

I noticed a lot of writers use acronyms in their writeups when I initially started reading different deep dives, which made it exceedingly difficult for me to follow up. This is why I strive to keep my articles as simple as possible so that even inexperienced investors may understand them. Being a newbie myself makes it easier for me to share my thoughts with those who are just getting started.

“It often happens that two schoolboys can solve difficulties in their work for one another better than the master can. […] The fellow-pupil can help more than the master because he knows less. The difficulty we want him to explain is one he has recently met. The expert met it so long ago he has forgotten. He sees the whole subject, by now, in a different light that he cannot conceive what is really troubling the pupil; he sees a dozen other difficulties which ought to be troubling him but aren’t.” - C. S. Lewis

The End Goal

So, what really is my end goal in writing/investing?

I'd like to be able to help fellow investors better understand some of the companies they own. I frequently see people owning businesses that they do not understand. I want to be able to bridge the knowledge gaps that investors have about the companies they own. What is the most enjoyable aspect of writing? Every time I write a deep dive, I gain a better understanding of the companies I own. If you continue to read my articles, I hope you will expand your knowledge along with me.

The key to accomplishing this is to learn from people who are far smarter than me, way out of my league, connecting with like-minded people, and teaching it to people who are just getting started in investing.

I want to be able to generate good alpha for the portfolios I help manage (for my family members), and my target CAGR is 25%. I know it sounds lofty. But, if I'm going to devote time to becoming a better investor, I believe I must set a high bar for myself. Why bother picking stocks if I'm going to aim for a CAGR of 10% or higher? To get that kind of result, I can simply index my way through.

I'd like to pen down some of the investing lessons I learned after dabbling in the world of investing so that my readers don't make the same mistakes I did.

To do so, I plan to devote a significant amount of time this month to reading up on other authors' deep dives, reading the month-end reviews of some of the best investors out there, and listening to the best podcasts and interviews ever conducted. Over time, I’ll also share with you some of the best investing resources out there that I use to get better myself.

Maybe, just maybe, start my own small fund one day and help my friends invest. My point here is if you feel like trying out something, something you’ve never done before, just take a leap of faith and try it. What do you have to lose?

Long road ahead

I've only been investing for a year and a half, but I believe I'm a much better investor than I was a year ago. It will most likely take many more years of experience to become as good an investor as some of the people I follow.

The path to becoming a better investor will most likely take many turns and curves, but if you don't stop learning, you'll arrive at the endpoint one day.

Thanks for reading! I have written an earnings review of Crowdstrike (CRWD) for Potential Multibaggers, so I’ll probably be able to publish that within this week.

If you’d like to follow my investing journey, you can follow me on Twitter @BlueOceanInv as well! :)

You're an excellent writer Nathan and your deep dives are incredibly thorough and inspirational. Keep it up!

Well done Nathan 👏 Keep going 💪